- ₹10k

- 10L

- 20L

- 30L

- 40L

- 50L

- 60L

- 70L

- 80L

- 90L

- ₹1Cr

- ₹0

- 10L

- 20L

- 30L

- 40L

- 50L

- 60L

- 70L

- 80L

- 90L

- ₹1Cr

- 0%

- 15%

- 1

- 30

₹

₹

- ₹5L

- 50L

- 1CR

- 1.5CR

- 2CR

- 2.5CR

- ₹3Cr

- 1

- 21

- 12

- 360

- 1%

- 21%

- 12

- 360

Monthly EMI

You Save ₹10,201/month

Total Amount Paid

- ₹0

- 10L

- 20L

- 30L

- 40L

- 50L

- 60L

- 70L

- 80L

- 90L

- ₹1Cr

- ₹10k

- 10L

- 20L

- 30L

- 40L

- 50L

- 60L

- 70L

- 80L

- 90L

- ₹1Cr

- ₹0

- 10L

- 20L

- 30L

- 40L

- 50L

- 60L

- 70L

- 80L

- 90L

- ₹1Cr

- 0%

- 15%

- 1

- 30

₹65,43,590

₹50,43,590

₹60,000

₹40,000

Home Loan Eligibility

Determining your eligibility for a Home Loan is crucial before initiating the application process. This eligibility table will outline the key factors lenders consider, including income, credit score, employment status, age and property value, helping you assess your likelihood of approval and plan your home purchase journey effectively.

Eligibility Criteria |

Salaried and Self-Employed |

|---|---|

Income Criteria |

Minimum salary for ICICI Bank Home Loan: Rs 25,000 |

Age Criteria |

Minimum: 21 years, Maximum: 70 years |

Loan Tenure |

Up to 30 years |

Loan Amount |

No cap, depending on your eligibility |

Nationality |

Indian |

Home Loan Interest Rates & Charges

Explore Home Loan Interest Rates and Charges with the table given, outlining the costs and rates involved in securing your home financing.

Home Loan Interest Rate (Pre-approved Customers)

Pre-approved customers at ICICI Bank stand to benefit from preferential Home Loan rates, which are lower than standard rates. These rates are tailored to reward loyalty and financial stability *T&Cs. Subject to bureau score. Applicable to customers with pre-approved Home Loan offer only.

Current Home Loan Interest Rate |

8.75%* p.a. |

Special Home Loan Interest Rates

Special Home Loan interest rates, often lower than standard, are offered for a limited time or to eligible customers, serving as incentives or promotional offers. Below are the special Housing Loan interest rates:

CIBIL |

Salaried |

Self-Employed |

|---|---|---|

>800 |

9.00% |

9.00% |

750-800 |

9.00% |

9.10% |

Standard Home Loan Interest Rates

Standard Home Loan interest rates apply uniformly to all applicants, determined by market conditions and creditworthiness. Below are the standard Housing Loan interest rates:

Loan Slab |

Salaried |

Self-Employed |

|---|---|---|

Up to ₹ 35 lakhs |

9.25% - 9.65% |

9.40% - 9.80% |

₹ 35 lakhs to ₹ 75 lakhs |

9.50% - 9.80% |

9.65% - 9.95% |

Above ₹ 75 lakhs |

9.60% - 9.90% |

9.75% -10.05% |

Home Loan Fees & Charges |

||

Processing Fees |

0.50% of the loan amount plus applicable taxes |

|

Prepayment Charges |

||

The above rates are linked to Repo Rate:

* Current Repo rate 6.50%.

* Valid till 31st Oct, 2024

Documents required to apply for a Home Loan

Here are mandatory documents required for home loan such as a proof of identity, a proof of address, a loan application form that has been duly filled and your financial documents. Below is the detailed list of documents required for home loan:

- Submit your Aadhaar card, passport or driving licence for KYC

- For address proof, your utility bills, or rent agreement with your current address works fine

- *For income proof, ICICI Bank needs your salary slips, income tax returns or Form 16

- Submit the title deeds of the property and construction approvals

- **Prove your financial stability by submitting bank statements for the last 6 months

- Provide your job offer or appointment letter for a stress-free experience

- If applicable, submit your co-applicants’ documents for joint loan applications.

NOTE: No salary slip is required in case the customer has a salary account at ICICI Bank.

Features & Benefits of ICICI Bank Home Loan

Maximising Your Home Loan Approval: Dos and Don'ts

| Dos | Don'ts |

|---|---|

Investigate loan and property details thoroughly. |

Avoid applying for a Home Loan on multiple aggregator sites to maintain approval chances. |

Plan for unexpected expenses wisely. |

Refrain from carrying excessive loans to maintain a favourable creditworthiness. |

Keep all necessary paperwork organised. |

Avoid overspending on Credit Cards or delaying loan repayments to prevent a negative impact on your credit score. |

Improve your credit before applying for a Home Loan. |

Don't commit to a Home Loan beyond your means to ensure manageable repayments. |

Home Loan FAQs

What is a home loan?

A home loan is essentially a financing option where funds are provided to an individual or an entity for the purchase, construction, extension, or renovation of a residential or commercial property. Lenders provide funds upfront, and borrowers repay through monthly installments, usually over many years. It's crucial for prospective homeowners to understand the terms, interest rates, tenure, and eligibility criteria before applying.

How do I apply for a home loan?

You can apply for a home loan from ICICI Bank through our website here. Or, you could visit the nearest branch of ICICI Bank to submit your application for a loan.

What are the parameters for arriving at Housing Loan eligibility?

Home Loan eligibility is determined by factors like age, income, employment stability, credit score, existing financial obligations and nationality. For ICICI Bank, applicants aged 20-65 (salaried) or 21-70 (self-employed), with a minimum income of Rs 25,000, stable employment or business record, a good credit score of 700+, and Indian nationality are eligible. These parameters ensure a comprehensive assessment aligning with the bank's policies and regulations.

Housing Loan Value Added Services

Explore our unique Home Loan solutions

See how easy it is to get a Home Loan! Watch Now

Apply for Home loan

at your convenience

- Mobile Banking

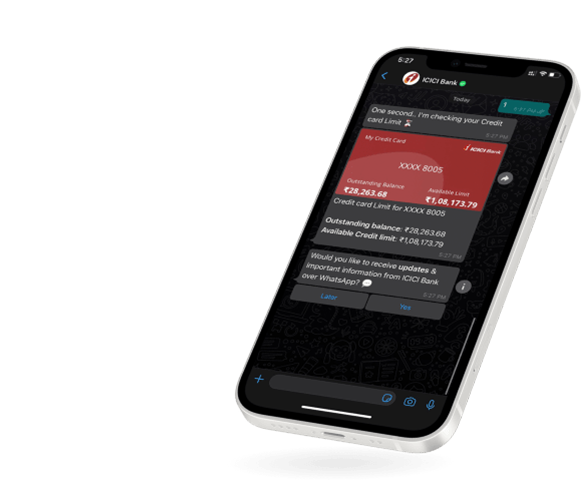

- Net Banking

- WhatsApp Banking

Apply for Home loan

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking

Scan to check your pre-approved offer

Your dream home is just a few clicks away!

With Digital Home Loans from ICICI Bank.