Education Loan Interest Rates

| Interest Rates | Information |

|---|---|

[REPO* + 3.75%(Spread)] onwards |

|

Unsecured Loan Amount – Up to ₹ 1 Crore |

|

Education Loan Eligibility

| Particulars | Eligibility |

|---|---|

Nationality |

Indian |

Age |

Minimum - 16 years and Maximum - 35 years |

Academic record |

Proven - good |

Qualification |

Completed 10+2 (12th Standard)/Diploma |

For Pursuing |

Graduation/Postgraduate Degree or a PG Diploma in Professional Education. |

University Applied to |

Listed, Recognised and Accredited Institutes in India and Overseas |

Loan can be sanctioned based on |

|

Loan Amount |

|

Co-borrower |

Father, Mother, Brother, Sister, Spouse (Husband/Wife), Grandparents, Parents-in-law, Maternal/Paternal Uncle. |

Security |

Property i.e. House or Flat, Fixed Deposit, Existing ICICI Bank Home Loan for cross-collateral. |

Required Documents for Education Loan

How to Apply For Education Loan

Why to Choose ICICI Bank for Education Loan?

Special Product offering

for Canada, UK & Germany

No margin for Premium

Institutes

No Branch Visits/ Complete

digital Journey

Pre- admission

sanction

Education Loan FAQ

What is the eligibility criteria to apply for an Education Loan?

For Education Loan Eligibility, Indian citizens must be 16 to 35 years of age with a good academic record and should have completed 10+2 or diploma. If the applicant is enrolled in a recognised institute in India or overseas, loans are sanctioned based on pre-admission, entrance exam scores, 12th/HSC results or confirmed admissions.

What are the courses for which one can avail an Education Loan?

Graduate/Postgraduate/Diploma courses in professional education from recognised and accredited institutes in India and overseas.

Can I avail partial fee as Study Loan?

Yes, you can avail partial fee as Loan at any point of time during your studies.

Education Loan Videos

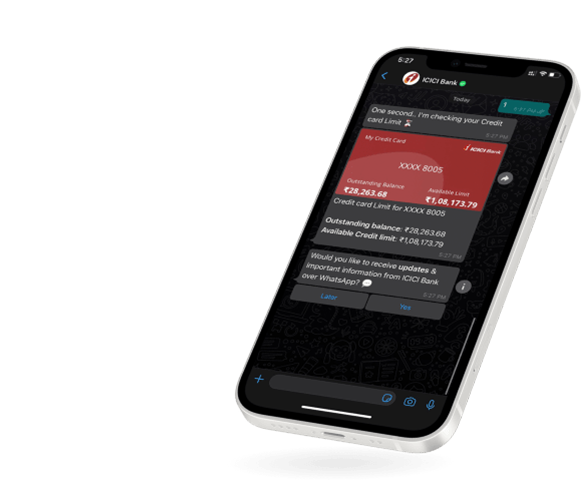

Apply for Educational loan

at your convenience

- Mobile Banking

- Net Banking

- WhatsApp Banking

Apply for Educational loan

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking