Why ICICI Bank for Education Loan?

Special Product offering

for Canada, UK & Germany

No margin for Premium

Institutes

No Branch Visits/ Complete

digital Journey

Pre- admission

sanction

Education Loan Interest Rates

| Interest Rates | Information |

|---|---|

| [REPO* + 3.75%(Spread)] onwards | For courses in India: Up to Rs 1 Crore For courses abroad: Up to Rs 2 Crore |

| Unsecured Loan Amount – Up to Rs 1 Crore | |

Education Loan eligibility

| Particulars | Eligibility |

|---|---|

| Nationality | Indian |

| Age | Minimum- 16 years Maximum- 35 years |

| Academic record | Proven - good |

| Qualification | Completed 10+2 (12th Standard)/Diploma |

| For Pursuing | Graduation /Postgraduate Degree or a PG diploma in professional Education. |

| University Applied to | Listed,Recognized and Accredited Institutes in India and Overseas |

| Loan can be sanctioned on the basis of |

|

| Loan Amount |

|

| Co-borrower | Father, Mother, Brother, Sister, Spouse (Husband/Wife), Grand Parents, Parents in law, Maternal/Paternal Uncle. |

| Security | Property i.e. House or Flat, FD –Fixed Deposit, Existing ICICI Bank Home Loan for cross collateral. |

Required Documents for Education Loan

How to apply for Education Loan

Education Loan FAQ

What is the eligibility criteria to apply for an Education Loan?

To apply for a student loan, Indian citizens must be 16 to 35 years of age with a good academic record and should have completed 10+2 or diploma. If the applicant is enrolled in a recognised institute in India or overseas, loans are sanctioned based on pre-admission, entrance exam scores, 12th/HSC results or confirmed admissions.

What are the courses for which one can avail an Education Loan?

Graduate/Postgraduate/Diploma courses in professional education from recognised and accredited institutes in India and overseas.

Can I avail partial fee as Loan?

Yes, you can avail partial fee as Loan at any point of time during your studies.

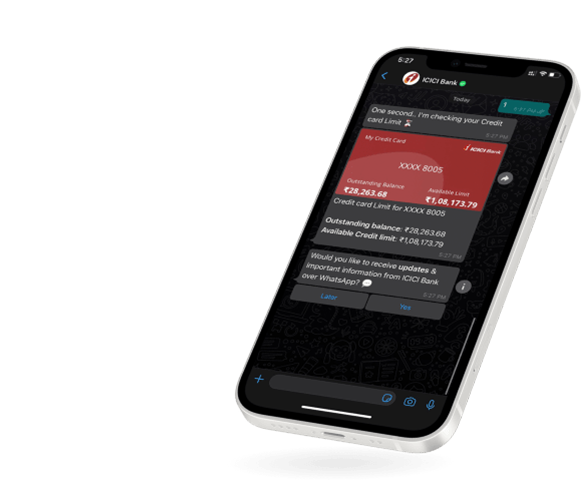

Apply for Educational loan

at your convenience

- Mobile Banking

- Net Banking

- WhatsApp Banking

Apply for Educational loan

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking