What iFinance brings to You?

Enhance your banking experience with iFinance

Discover Financial Insights

Category-wise spending summary

Cumulative income and expenses

Top 5 debit and credit transacations

How to Activate iFinance?

Link All Bank(s) accounts | ICICI Bank Introducing iFinance| iMobile Pay App

Link All Bank(s) accounts | iFinance | ICICI Bank Internet Banking

iFinance FAQs

What is iFinance?

iFinance is a feature available on ICICI Bank digital platforms such as Internet Banking and Mobile app (for both individual and self-employed segments). It is powered by our Account Aggregator Technical Service (through Financial Information Providers or FIPs), which lets you fetch and view information of all your Accounts linked to your registered mobile number, held at other banks as well. iFinance offers a comprehensive view of your statements, including bank balances, top spending and income categories, expenses, expense breakdowns, daily inflows and balance analyses.

Why should I connect my other bank Accounts to my ICICI Bank app?

It has been a challenge for customers to visit different banks’ branches or navigate through different banking apps to access Account related information. iFinance brings you a one-stop digital solution to get a consolidated view of all your Bank Accounts and balances, in a single window. It also offers a summary and analysis of your income and expenses, where and how you have spent money from all your Accounts. This helps you exercise better control over your transactions and monitor your finances seamlessly.

How do I connect my other bank Accounts to my ICICI Bank app?

To connect your other bank Accounts:

Log in to ICICI Bank (Internet Banking or mobile application)

Click on iFinance, verify your mobile number through OTP

Upon successful verification, link all your Accounts:

Select the banks that you want to link

Upon providing consent for each bank, your Accounts from other banks (FIPs) will be linked

Get ready to view consolidated balances and transactions in one place.

Related Videos

Banking

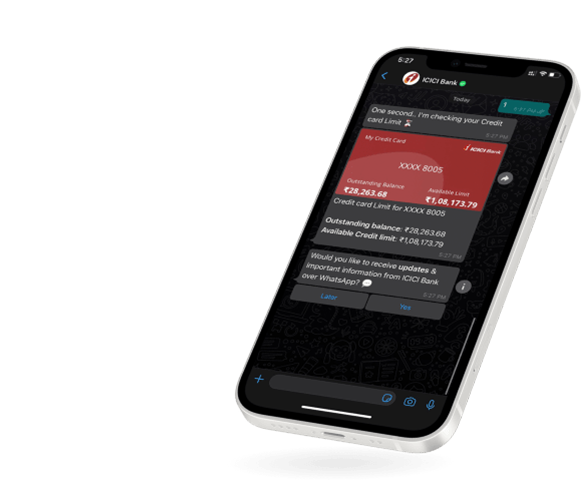

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking