What are Mutual Funds?

Mutual Funds are investment pools where money from various investors is collected and then invested in a diversified portfolio of assets like stocks and bonds. Investors in Mutual Funds own shares of the fund, which, in turn, owns shares in other companies or government bonds.

The investors cannot directly own the stocks held by the fund. They share in the profits or losses of the entire fund equally. This shared ownership model is why they are called 'Mutual Funds,' offering investors a way to access a diversified portfolio without needing to directly manage individual mutual fund investments.

Advantages of Mutual Funds

These are some of the advantages of investing in Mutual Funds

Diversification

Mutual funds offer diversification by investing in a variety of assets, spreading risk across different securities. It helps investor’s portfolio from market volatility.

Professional Management

Experienced fund managers with a rich experience in the market make investment decisions, leveraging their expertise for potentially higher returns.

Liquidity

Mutual funds offer high liquidity, which means investors can buy or sell fund units at any time, providing flexibility to their investments.

Tax Benefits

ELSS mutual funds offer tax advantages, allowing investors to save up to Rs 1.5 lakh under Section 80C with a three-year lock-in period.

Affordability

Mutual funds are an affordable means of investment, which makes them accessible to investors with varying capital levels, making them affordable for all.

Safe Investment

Mutual funds investments are regulated by SEBI, and provide a safe investment option for investors seeking stability and growth

What are the types of Mutual Fund investments?

The types of Mutual Fund (MF) investments can be broken down depending on different factors - here are the different types:

Types based on Asset Class

- Equity Funds: Invest in company shares, offering high growth potential.

- Debt Funds: Invest in bonds, providing steady income.

- Money Market Funds: Invest in low-risk, short-term securities.

- Hybrid Funds: Blend stocks and bonds for growth and stability.

Types based on Investment Goals

- Growth Funds: Aim for capital appreciation with high-growth stocks.

- Income Funds: Generate regular income through bonds and dividends.

- Liquid Funds: Prioritise liquidity and safety with short-term debt.

- Tax Saving Funds: Provide tax benefits under Section 80C with equity investments.

Types based on Structure

- Open-ended Funds: Offer continuous buying and selling flexibility.

- Closed-ended Funds: Have fixed maturity periods and limited units.

- Interval Funds: Combine features of open and closed-ended funds.

Types based on Risk

- Very Low-Risk Funds: Invest in low-risk securities for capital preservation.

- Low-Risk Funds: Aim for income generation with slightly higher risk.

- Medium Risk Funds: Balance growth and risk with equity and debt investments.

- High-Risk Funds: Focus on capital appreciation with increased volatility.

- Specialised Mutual Funds: Investment options tailored to meet specific goals.

- Sector Funds: Focus on specific industries or sectors for potential performance.

- Index Funds: Cost-effective exposure to overall markets or specific segments.

- Funds of Funds: Diversified portfolios through investing in other mutual funds.

- Emerging Market Funds: Growth opportunities in developing economies with higher risk.

- International/Foreign Funds: Diversification beyond domestic markets for potential returns.

- Global Funds: Blend domestic and foreign investments for broad diversification.

- Real Estate Funds: Exposure to the real estate market without direct property ownership.

- Commodity-focused Stock Funds: Indirect exposure to commodity markets through related companies.

- Market Neutral Funds: Balanced positions to generate returns with reduced market risks.

- Inverse/Leveraged Funds: Unique strategies providing inverse returns or amplifying performance.

- Asset Allocation Funds: Automatic portfolio adjustments for specific risk-return profiles.

- Gift Funds: Charitable giving with tax advantages and support for causes.

- Exchange-Traded Funds (ETFs): Liquidity and diversified exposure combining mutual fund and stock elements.

Why Investing in Mutual Funds through ICICI Bank?

How to invest in

Mutual Funds?

Explore Our Mutual Fund Videos

Mutual Fund FAQs

Is Mutual Fund a good investment?

Mutual Funds are a good investment option for investors looking to diversify their portfolios. Instead of taking exposure to only one company or industry, a Mutual Fund investor invests in different securities and minimises your portfolio's risk.

How are returns earned in Mutual Funds?

Mutual Fund returns are calculated by computing appreciation in the value of your investments over a period as compared to the initial investment. The Net Asset Value of Mutual Fund indicates its price and is used in calculating returns for your Mutual Fund investments. Using a MF Calculator, you can easily calculate the returns on your mutual fund investment.

Are Mutual Funds taxable?

By investing in Mutual Funds, an investor can earn returns in the form of capital gains and dividend* income, which are taxable in the hands of the investor.

- A capital gain /loss arises when an investor sells any number of units of Mutual Funds

- An investor receives a dividend in proportion to the number of units held at the time of announcement of dividend, which gets distributed by companies to investors when they earn a surplus.

Tax on Capital Gains Received from Mutual Funds:

The capital gains depend on the period of holding (short term or long term) and the type of capital asset.

- In the case of Equity Mutual Funds, an investment tenure of less than 1 year (12 months) is a short-term investment. Any investment of over one year is a long-term investment

- Until March 31, 2023, in the case of Debt Mutual Funds, an investment tenure of up to 3 years (36 months) is a short-term investment and any investment of over 3years is considered as long-term. However, from April 01, 2023, capital gains from Debt Mutual Funds purchased on or after April 01, 2023 (i.e. a fund which invests up to 35% of its proceeds in the equity shares of domestic companies) are to be considered as short-term capital gains irrespective of the period of holding.

Fund Type |

Short-term capital gains |

Long-term capital gains |

Equity Funds |

15% cess + surcharge |

Any gain above Rs 1,00,000 in a financial year is taxable 10% + cess + surcharge |

Hybrid Equity-oriented Funds |

||

Debt Funds (Purchased before April 01, 2023) |

Taxed at the investor’s income tax slab rate |

20% with indexation + cess + surcharge |

Hybrid Debt-oriented Funds (Purchased before April 01, 2023) |

||

Debt Funds (Purchased on or after April 01, 2023) |

Taxed at the investor’s income tax slab rate |

NA |

Hybrid Debt-oriented Funds (Purchased on or after April 01, 2023) |

Equity funds/Equity oriented funds STT should be paid at the time of sale. In case it is not paid, short term capital gains are taxable at slab rate and long term capital gains are taxable at 20% plus surcharge and cess.

Tax on Dividend* Income received from Mutual Funds:

- From April 1, 2020, Mutual Fund dividends are taxable in the hands of investors. The dividend income is taxable under the head “income from other sources” at the applicable income tax slab rate for the financial year

- In addition to such a taxation, the distributor of dividend* income must deduct TDS (tax deducted at source) at a rate of 10%. However, TDS will not be deducted if the total dividend paid by the distributor during the financial year is less than Rs 5,000

- If the investor fails to provide the PAN to the distributor ,TDS will be deducted at a rate of 20%

- For Non-Resident Individuals, TDS is required to be deducted at the rate of 20% subject to the Double Taxation Avoidance Agreement (DTAA), if any.

*As per the Securities and Exchange Board of India’s (SEBI) circular, ‘Dividend Plan’ is renamed as ‘Income Distribution cum Capital Withdrawal Plan’ or ‘IDCW Plans’ with effect from April 1, 2021 .

Disclaimer

Terms and Conditions of ICICI Bank, as available on www.icicibank.com and Terms and Conditions of the third parties apply. ICICI Bank is not responsible for third party products, goods, services and offers. Customers shall be deemed to have read, understood and consented to these Terms and Conditions.

Nothing in this document is intended to constitute advice of any kind including legal, tax, security or investment advice or opinion regarding the appropriateness of any investment(s) or an offer, invitation or solicitation for any product(s) or service(s) and does not intend to create any rights or obligations.

The use of any information set out herein is entirely at the recipient’s own risk. ICICI Bank does not accept any responsibility for any errors whether caused by negligence or otherwise or for any loss(es) or damage(s) incurred by anyone by placing reliance on anything set out in this document, including any loss(es) or shortfall(s) resulting from the operations of the Mutual Funds. The information set out herein may be subject to updation, completion, revision, verification and amendment.

For a "Fund of Funds" scheme, investors may please note that they will be bearing the recurring expenses of the relevant Fund of Funds Scheme in addition to the expenses of the underlying schemes in which the Fund of Funds Scheme makes investment.

ICICI Bank is acting merely as a distributor/corporate agent/point of service for the third party(ies). Any investment(s) in such third party product(s)/service(s) shall constitute a contract between the investor and the third party. ICICI Bank shall not be liable or responsible for any loss(es) resulting from the third party’s product(s). The contract, with regard to the Mutual Fund is between the asset management company and the investor and not between ICICI Bank and the investor. Participation by ICICI Bank’s customers is on a purely voluntary basis and there is no direct or indirect linkage between the provision(s) of the banking services offered by the Bank to its customers and their usage of the product(s) or participation in the scheme. Please visit www.icicibank.com/Personal-Banking/investments/mutual-funds/disclosure page for more details.

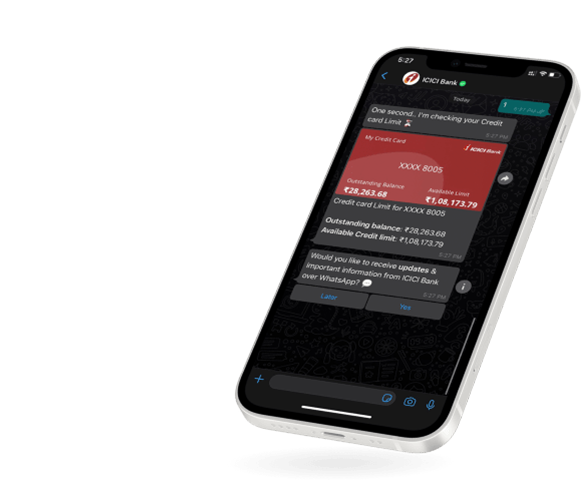

Invest in Mutual Fund,

Anywhere Anytime

- Mobile Banking

- Net Banking

- WhatsApp Banking

Invest in Mutual Fund,

Anywhere Anytime

Mobile Banking | Net Banking

WhatsApp Banking