Apply for a Credit Card Loan

How to avail an ICICI Bank Personal Loan on Credit Card through Internet Banking?

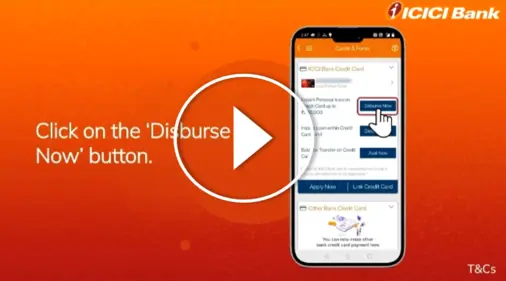

Avail an ICICI Bank Personal Loan on Credit Card through iMobile Pay.

Consent Clause

Customer consent for information usage

I/ We hereby authorise and give consent to ICICI Bank to disclose, transfer or part with any of my/ our information (including location) or any other device information, when the Bank considers such disclosure necessary to:

ICICI Bank agents and ICICI Bank group entities in any jurisdiction

Auditors, credit rating agencies/ credit bureaus, statutory/ regulatory authorities, governmental/ administrative authorities, Central Know Your Customer (CKYC) registry or SEBI Know Your Client registration agency having jurisdiction over ICICI Bank or its group entities

Service providers or such persons with whom ICICI Bank contracts or proposes to contract.

(Collectively referred to as ‘Permitted Persons’)

For purposes including:

Provision of the facility

Completion of onboarding formalities

Compliance with KYC requirements

Compliance with applicable laws or any order (judicial or otherwise) or statutory/ regulatory requirements

Availing credit review of facilities

Authentication or verification

Research or analysis, credit reporting & scoring, risk management, participation in any telecommunication

Electronic clearing network for processing of the said information/ data

Disclosing any default in payment for the purpose of recovering such amounts.

To know more about the privacy policies of ICICI Bank, please visit: https://www.icicibank.com/privacy

Terms and Conditions for Personal Loan on Credit Card (PLCC)

I. Definitions:

In these terms and conditions, unless there is anything repugnant to the subject or context thereof, the expressions listed below, if applicable, shall have the following meanings:

- "Card Member", for the purpose of these Terms and Conditions, means the individual to whom a credit card has been issued by ICICI Bank Limited (“ICICI Bank”) and who has availed of the Facility.

- "Credit Limit" means the limit up to which the Card Member is authorized to spend on his/her credit card.

- "Cash Limit" means the maximum amount of cash or equivalent of cash as defined or prescribed by ICICI Bank, that the Card Member can withdraw on his/ her Card Account. Cash Limit forms a subset of the Card Member's Credit Limit/Purchase Limit.

- “Card Account” means the account opened in the name of the Card-Member and maintained by ICICI Bank for the purpose of usage of the Credit Card as per the Primary Terms and Conditions.

- “Customer” means an individual to whom a credit card has been issued by ICICI Bank.

- "EMI" or "Equated Monthly Instalment" means the equated monthly instalments of amounts payable by the Card Member to ICICI Bank in respect of the Facility and comprises of the principal amount of the Facility and interest thereon.

- "Facility" or "PLCC" means the ‘Personal Loan on Credit Cards’ provided/ agreed to be provided by ICICI Bank, at its sole discretion, to the Card Member, either to the extent of amounts not exceeding the available Cash Limit and/or Credit Limit or for an amount over the available Cash Limit and/ or Credit Limit, through an additional account linked to existing Card Account. The "Facility" or "PLCC" may also be referred to as "Cash-in" or "Cash-in Select".

- "MITC" means the Most Important Terms and Conditions governing the credit card issued by ICICI Bank, a copy of which is provided by ICICI Bank to the Card Member and is available at https://www.icicibank.com/managed-assets/docs/personal/cards/mitc_cc.pdf

- “Primary Card Member” is the person in whose name the Card Account has been opened and to whom the card has been issued.

- "Primary Terms and Conditions" means the terms and conditions governing the credit card issued by ICICI Bank, as is available at www.icicibank.com/managed-assets/docs/personal/cards/credit-cards/tnc_english.pdf .

- "Terms and Conditions" shall mean the terms and conditions for PLCC.

II. Usage of the Facility:

- The Facility shall be available only to a Customer, who has been pre-approved by ICICI Bank for availing of the Facility, approval with respect to which is at the sole discretion of ICICI Bank. The Customer can request for an amount up to the available Cash Limit and/or Credit Limit on the Card Account or for an amount over the available Cash Limit/ Credit Limit and such amounts shall be disbursed immediately in the form of transfer to his/her ICICI Bank liability account or through National Electronic Funds Transfer (NEFT) or such other mode as may be communicated by ICICI Bank, from time to time. The final approval of the amount of the Facility to be granted is subject to the Customer's performance on the Card and the available Cash Limit and/or Credit Limit at the time ICICI Bank receives the Customer's request for the Facility. The Cash Limit and/or the Credit Limit on the credit card will be blocked by the amount for which the Facility is granted in cases where such amount forms part of the available Cash Limit and/or Credit Limit. The Card-Member shall be required to pay a non-refundable processing fee on the Facility up to the percentage specified by ICICI Bank to the Card Member. The cash-limit on the credit card will be blocked by the amount for which the facility is granted.

- Disbursement through NEFT to non-ICICI Bank account will be subject to successful processing at beneficiary bank’s end. Facility will be disbursed in 4 working days, subject to mandatory policy and credit checks.

- The Card Member hereby agrees to avail of the Facility on the precondition that he/she will not use the Facility, or any part thereof, towards capital market or for the purpose of repaying his/her ICICI Bank Card outstanding.

- The Credit Limit of the credit card will be blocked by the amount which is equal to billed EMI/EMIs + applicable taxes and fees, including processing fees and the same needs to be maintained in the Credit Limit else Over The Limit (OTL) charges along with charges as per MITC will be applicable. In case of OTL, except the above amount, the assigned credit limit of the card will not be affected. In case of availing of PLCC – Within The Limit (WTL) Facility, Credit Limit will be blocked by the amount equal to PLCC WTL availed.

- The Card Member understands that by clicking on the ‘I Agree’ button, he/she is entering into a valid and binding contract with ICICI Bank and the same shall be enforceable and binding as per Section 10A of the Information Technology Act, 2000 and the same shall be admissible as an electronic record under Section 65B of the Indian Evidence Act, 1872.

- The Card Member hereby allows use of such information that had been provided at the time of applying for the credit card for the completion of documentation for the Facility as well as any other offers ICICI Bank may wish to extend to the Card Member.

- The Card Member when availing of PLCC-WTL hereby allows for an increase in his/her credit limit by 10% or by the shortfall amount, if the minimum limit required to avail of PLCC-WTL is not maintained.

III. Repayment:

- The Card Member shall repay the Facility and interest thereon in EMIs. The interest shall be at such rate which has been indicated by ICICI Bank to the Card Member at the time of making the offer for the Facility. The interest calculation will start from the time the request regarding the Facility has been confirmed by the Card Member. The amount of the EMIs together with other details of the Facility (including rate of interest) shall also be communicated to the card member at his/her registered e-mail/mailing address. In cases where the customer has availed of this loan facility, the amount of EMI due for a particular month shall be subsequently reflected in the card statement for that particular month. Processing fees and related taxes will be levied in addition to EMI amount in the subsequent statement generated post Facility approval. By availing of the Facility, the Card Member authorises ICICI Bank to debit the Savings Account of the Card Member on a monthly basis for the minimum amount due for that particular month, as has been intimated to the Card Member through the Statement. Principal and interest will be mentioned separately in the Statement. The Cash Limit and/or Credit Limit shall be reinstated to the extent of the amount of EMI repaid by the Card Member.

- Goods and Services Tax (GST) will be applicable on the interest component of the EMI every month.

- The Card Member shall be required to pay the entire amount of the EMI for a particular month on the Payment Due Date as indicated in the Statement and the same shall not be permitted to be carried forward/included in the next Statement. In the event the payment is not made by the payment due date, it shall be construed as a default by the Card Member and Card Member shall become liable to pay the amount together with late payment charges, as specified in the Primary Terms and Conditions.

IV. Prepayment of Facility:

- If the Facility is prepaid/ terminated before the tenure of the Facility, the amount of the Facility outstanding at the time of prepayment/termination together with all interest thereon and all other monies in respect of the Facility shall become repayable by the Card Member. In addition to this, Card Member is liable to pay pre-closure charges along with interest of upcoming unbilled EMI.

- The Card Member may prepay the Facility at any time by contacting ICICI Bank's 24 Hour customer care. The Card Member shall pay such prepayment charges as may be indicated by ICICI Bank in the communication sent to the Card Member at the time of granting the Facility.

- ICICI Bank shall, without prejudice to all rights and remedies, have the right to call upon the Card Member to forthwith repay the Facility, all interest thereon and all other monies in respect of the Facility upon occurrence of Event of Default (hereinafter specified) in repayment of the amount of the Facility and the Card Member shall be liable to repay all such amounts upon such demand.

V. Cancellation of Facility:

- The Card Member may cancel the Facility within 15 days of receiving the transfer to his/her ICICI Bank liability account by contacting ICICI Bank's customer care.

- In case of non-ICICI Bank account transfer through NEFT, cancellation is subject to payment of the transferred funds to the Card Account. In case of transfer to his/her ICICI Bank liability account, the cancellation request can be raised at ICICI Bank's customer care and such amount will be reversed from the account, where the transfer was effected.

- In case of a demand draft, the Card Member may request for such cancellation at ICICI Bank's customer care or return the demand draft at the RTO address mentioned on the envelope.

- Such cancellation shall be subject to non-encashment of demand draft or the amount being available in the account to effect reversal, as the case may be.

VI. Particular Affirmative Covenants:

- The Card Member has understood ICICI Bank's method of calculating EMIs payable;

- The Card Member has understood and agrees that by availing of the Facility, the Card Member shall not be, unless otherwise stated by ICICI Bank in writing, eligible for any reward points whatsoever, whether awarded under the ICICI Bank Reward Points Scheme or any other Reward Points Scheme on the card that may be announced by ICICI Bank from time to time;

- The Card Member shall renew the card forthwith in the event the period of the card expires during the tenure of the Facility. In the event of failure of the Card Member to renew the Card as stated above, ICICI Bank shall be entitled to call upon the Card Member to forthwith repay the Facility without prejudice to all rights and remedies against the Card Member;

- The Card Member is deemed to have accepted these terms and conditions. The Card Member is aware that these Terms and Conditions are available at www.icicibank.com and has read and understood the same;

- Repayment by the Card Member of the entire amount of the Facility to ICICI Bank shall release the Credit Limit and/or Cash Limit for which the Card Member is eligible by virtue of holding the card;

- The Card Member shall make payment of all taxes, duties, levies (including GST) in connection with the Facility.

VII. Liabilities of the Card Member:

- ICICI Bank reserves the right to require the Card Member to make advance payment of one or more EMIs against grant of the Facility, and ICICI Bank shall have the right to adjust the amount of the advance EMIs towards the balance amount of the Facility, at its sole discretion.

VIII. Events of Default:

If one or more of the events specified in this clause ("Events of Default") occur or shall have occurred, ICICI Bank may call upon the Card Member to foreclose the Facility by a notice in writing to the Card Member.

- The Card Member's commission of a breach of any of the terms, conditions and covenants herein contained or having made any misrepresentation to ICICI Bank;

- The Card Member having been declared an insolvent;

- Any proceedings for misconduct having been initiated against the Card Member;

- The Card Member's failure to furnish any information or documents that may be required by ICICI Bank;

- The Card Member's entering into any composition with his/her creditors;

- The Card Member's defaulting on any of the terms and conditions of any other loan or facility provided by ICICI Bank to the Card Member;

- The existence of any other circumstances which, in the sole opinion of ICICI Bank, jeopardises ICICI Bank's interest;

- Upon the occurrence of any Event of Default as specified above, ICICI Bank shall be entitled to exercise rights and remedies available to it under the Terms and Conditions and also the Primary Terms and Conditions.

- The Card Member’s defaulting on the Primary Terms and Conditions applicable for Personal Loan on Credit card.

IX. Miscellaneous:

- Details of the processing fee, foreclosure fee, GST and interest rate applicable on the Facility shall be as per the amortisation schedule provided by ICICI Bank to the Card Member. Details of all other charges shall be as per the MITC.

- Nothing contained in the Terms and Conditions shall be construed as an obligation of ICICI Bank to continue to offer the Facility after the date of termination of the Facility. ICICI Bank reserves the right at any time, without previous notice, to add, alter, modify, change or vary all or any of the Terms and Conditions.

- The Facility shall be available to the Primary Card Member only, subject to the available Cash Limit and/or Credit Limit and will be provided to the Card Member requesting for the Facility, at the sole discretion of ICICI Bank.

- The competent courts in Mumbai shall have exclusive jurisdiction to deal with any dispute that may arise out of the Terms and Conditions or in respect of the Facility. The existence of a dispute, if any, shall not constitute a claim against ICICI Bank.

- In addition to the general right to set off or other right conferred by law or under any other agreement, ICICI Bank may, without notice, combine or consolidate the standing balance on the Card Member's Card Account, or the account linked to the Card Account, with any other account(s) that the Card Member maintains with ICICI Bank and its group companies, and set off or transfer money standing to his/her credit in such other account(s) in or towards the satisfaction of the Card Member's liability to ICICI Bank under his/her Card Account or the Facility.

- The Terms and Conditions governing the Facility shall be in addition to and not in substitution or derogation to the Primary Terms and Conditions.

- The Terms and Conditions shall be read along with and are also in addition to the terms and conditions as applicable to ICICI Bank Savings Account and terms and conditions governing NEFT as provided at www.icicibank.com/managed-assets/docs/terms-condition/TERMSANDCONDITIONSNEFT.pdf.

- The Card Member has/have no objection to ICICI Bank Limited and its representatives providing information on various products, offers and services provided by ICICI Bank Limited/third parties through any mode (including without limitation through telephone calls/SMSes/e-mails) and authorise ICICI Bank Limited, representatives for the above purpose.

- The Card Member acknowledges that ICICI Bank may also share the Card Member’s information with any parent, subsidiary, affiliate or associate of ICICI Bank, for the purposes of marketing and offering various products and services of ICICI Bank or its group companies, subsidiaries, affiliates and/or associates.

- All capitalised terms used herein, but not defined, shall have the meaning ascribed to them in the Primary Terms and Conditions.

X. Customer consent for usage of their information:

I/We hereby authorise and give consent to ICICI Bank to disclose, transfer or part with any of my/our information (including location) or any other device information when the Bank considers such disclosure necessary with:

- ICICI Bank agents and ICICI Bank group entities in any jurisdiction

- Auditors, credit rating agencies/credit bureaus, statutory/regulatory authorities, governmental/administrative authorities, Central Know Your Customer (CKYC) registry or SEBI Know Your Client registration agency having jurisdiction over ICICI Bank or its group entities

- Service providers or such persons with whom ICICI Bank contracts or proposes to contract.

(Collectively referred to as ‘Permitted Persons’)

For purposes including:

- Provision of the facility

- Completion of onboarding formalities

- Compliance with KYC requirements

- Compliance with applicable laws or any order (judicial or otherwise) or statutory/regulatory requirements

- Availing credit review of facilities

- Authentication or verification

- Research or analysis, credit reporting & scoring, risk management, participation in any telecommunication

- Electronic clearing network and for use or processing of the said information/data

- Disclosing any default in payment for the purposes of recovering such amounts.

ICICI Bank Limited

ICICI Bank Tower, C - Wing

Autumn Estate, Near Chandivali Studio

Chandivali Farm Road,

Opp. Mhada Colony, Chandivali

Andheri (East), Mumbai 400072

Service Charges

Service charges & fees for Personal Loans on Credit Cards:

You can avail a Personal Loan on Credit Card at a lower interest rate, starting at 13% per annum with a flexible tenure of up to 60 months.

The interest shall be at a rate indicated by ICICI Bank to the card member at the time of extending the offer for the Facility. The interest calculation will start from the time the request regarding the Facility has been confirmed by the card member.

Goods and Services Tax (GST) will be applicable on the interest component of the EMI every month.

| Details about contingent charges | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

I |

Rate of annualised penal charges for delayed payments* |

a) Interest will be charged if the Total Amount Due is not paid by the payment due date. Interest will be charged on the Total Amount Due and on all new transactions (from the transaction date) until the previous outstanding amount is paid in full. The rate of interest may be changed at the sole discretion of ICICI Bank. It ranges from 1.25% per month (15% per annum) to 3.67% per month (44% per annum). GST will be applicable. b) Late payment charges on your card will be a function of the Total Amount Due and will be as follows:

|

||||||||||||||||

II |

Rate of other annualised penal charges* |

a) Auto-debit return charges: The charges will be applicable in case there is an auto-debit failure i.e. 2% of the Total Amount Due (subject to a minimum of Rs 500). GST will be applicable on the auto-debit failure fee. b) Over-limit fee: The fee will be applicable in case the credit limit on the card is breached while availing PLCC. 2.5% of the over limit amount (subject to a minimum of Rs 550) will be levied, except on ICICI Bank Emeralde Credit Card. GST will be applicable on over-limit fees. c) Foreclosure charges: The charges applicable are up to 3% of the outstanding principal amount. EMI for the next month (interest applicable as per the Amortisation table class="nri-rte-table") will be applicable in the event of pre-closure of the loan after the cooling off period. GST will be applicable. |

||||||||||||||||

Charges in case of delinquency: d) Charges incurred in filing a legal suit – at actuals |

||||||||||||||||||

e) Charges incurred in sending different notices – at actuals |

||||||||||||||||||

f) Pick-up charges per instance – Rs 500 + GST |

||||||||||||||||||

g) Cash transaction charges per instance for repayment of EMI dues at Branches – Rs 100 + GST |

||||||||||||||||||

III |

Cooling off/ look up period during which the borrower shall not be charged any penalty for cancellation / pre-payment of loan |

15 days |

||||||||||||||||

*The charges mentioned above (Section XII & XIII) should be considered with the Most Important Terms & Conditions (MITC) for Credit Cards. The rates mentioned above are subject to revision at the sole discretion of ICICI Bank.

Bank’s lending rate range: Q4 FY 2023-2024 (Jan 01, 2024 to Mar 31, 2024)

| Type of Credit Facility | Maximum | Minimum | Mean |

|---|---|---|---|

Personal Loan on Credit Card |

16% |

11% |

14.41% |

Notes:

The interest range provided above is for individual Personal Loans on Credit Cards disbursed during Q4 FY 2023-2024.

The mean rate of interest is computed on the basis of the sum of each rate of interest charged, divided by the sum of the number of accounts opened.

Annual Percentage Rate

The Annual Percentage Rate (APR) calculator is provided to compute annualised credit cost which includes interest and processing fees.

Net interest which will be displayed, will be based on inputs.

The APR does not include GST wherever applicable.

To calculate the same, please click here to download the APR calculator.

Personal Loan On Credit Card FAQs

Can I get a loan on my credit card?

Yes, you can get a personal loan on your credit card, subject to certain terms and conditions

Is it good to take out a credit card loan?

A credit card loan can be helpful for short-term financial needs, but managing repayments responsibly is essential.