Diversify your portfolio at ease with multiple investment products

I have just

Start

Earning

I want to do

Tax

Planning

I’m preparing

To

Retire

I’m looking for

Long-term

investment

I want to

Fulfil

dreams

I’m an

Early

investors

I want to

Save for

my daughter

I’m looking for

Short-term

investment

Sharpen Your Investment Skills

Investment FAQs

What are Mutual Funds and how do they work?

Mutual Funds are professionally managed funds that pool the savings of many investors and invest them in securities like stocks, bonds and short-term money market instruments. Investors in Mutual Funds have a common financial goal and their money is invested in different asset classes in accordance with the fund’s investment objective. Knowledge of a Mutual Fund scheme can be obtained from its Scheme Information Document (SID) and Fund Fact Sheet.

What is the process to invest in Mutual Funds through ICICI Bank?

You can invest in Mutual Funds by logging in to ICICI Bank Internet Banking. Click on the ‘Investments and Insurance’ section > Invest online > Invest in Mutual Funds. Alternatively, you can invest in Mutual Funds through ICICI Bank iMobile Pay > Click on the ‘Invest & Insure’ section > Invest > Mutual Funds.

Is Mutual Fund a good investment option?

Mutual Fund is a good investment option for investors looking to diversify their portfolios. Instead of exposure to only one company or industry, a Mutual Fund investor invests in different securities and minimises his/her portfolio's risk.

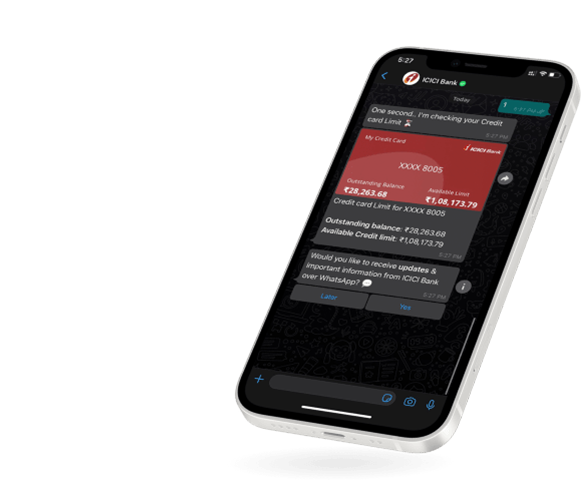

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

WhatsApp Banking