Steps for E-filing and E-verifying

E-filing helps in preparing and submitting the income tax return quickly through the internet. E-verification of it is needed for completing this process.

E-filing Income Tax Return is an important process to fill and submit your returns quickly. All the taxpayers, having income more than Rs. 5lakhs need to file their returns. The steps followed for e-filing are as under:

- Login to the Government portal for income tax e-filing http://www.incometaxindiaefiling.gov.in and download the Java or Excel utility of your Income Tax Return as per your income type.

- Fill up all the details required by the ITR, cross checking it with Form 16 or Form 16A or 26AS.

- After filling the details, validate the same. After completion of the validation process, log into the Income Tax account and upload the Java Utility of the Income Tax return. An XML file of the return can also be created, and the same can be uploaded on the income tax portal.

- An acknowledgment is generated on successful uploading of the income tax return.

- The process of verification starts after this.

Note: The process of e-filing can also be done online by logging into the website and selecting an option of e-filing income tax return: Prepare and submit online.

Once the taxpayer successfully files the return, verification of the same needs to be done for further processing of the Income Tax Return. ICICI eases your e-verifying process by proving you its service of e-verifying through net banking. The following steps need to be followed:

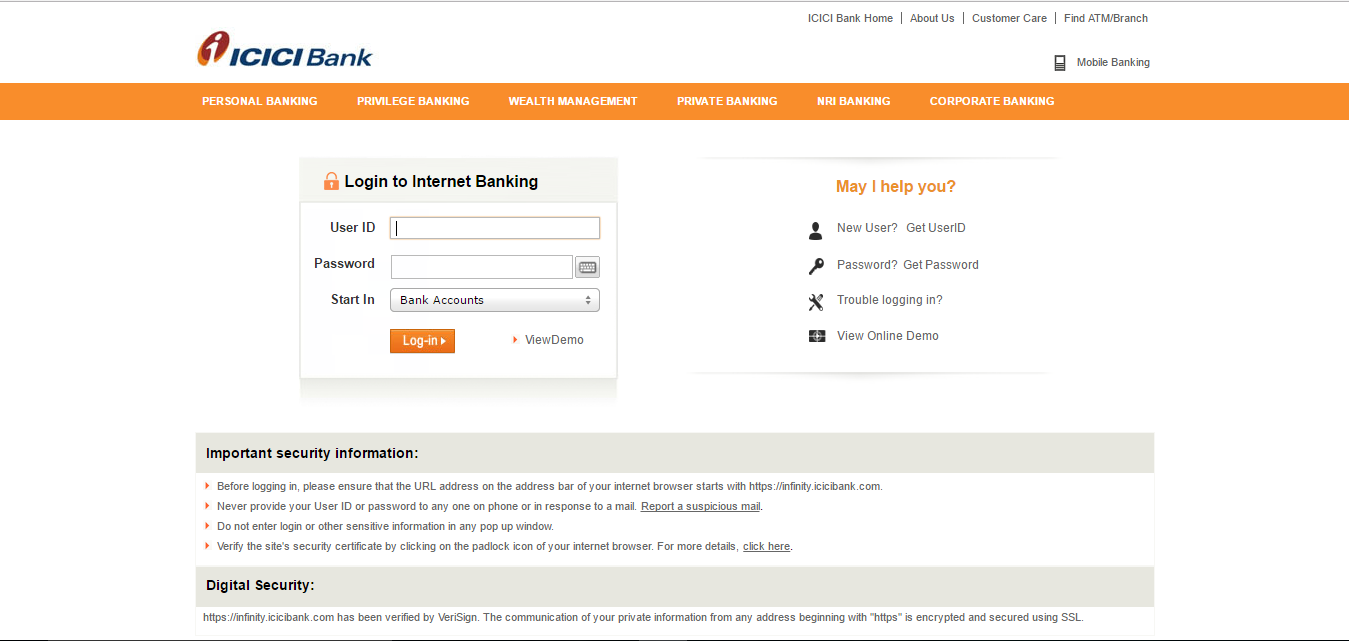

1. Sign in your Net banking account at the ICICI Bank website.

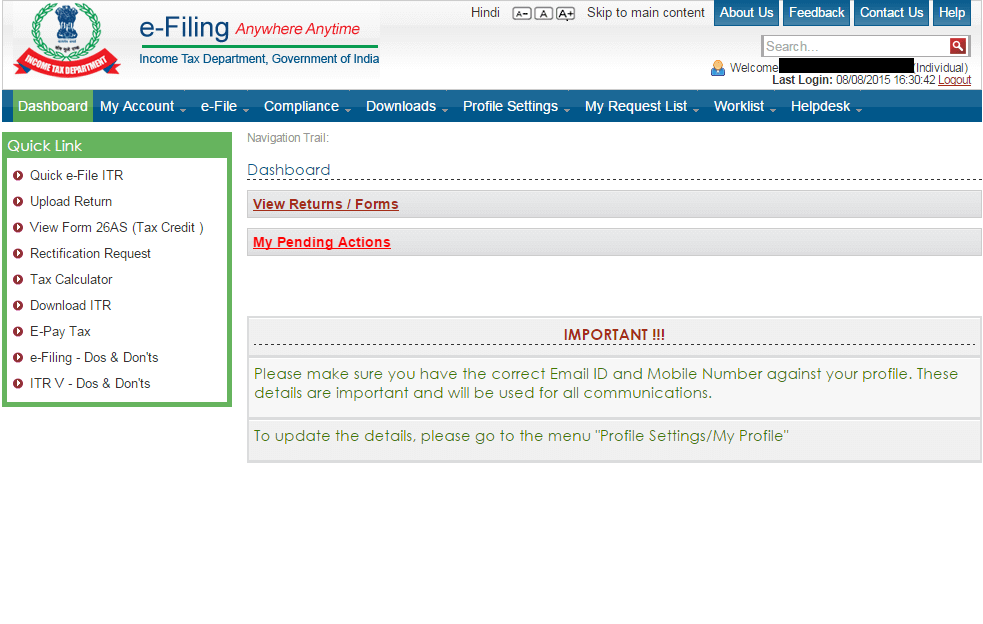

2. To see the e-filed returns, select View Returns/Forms.

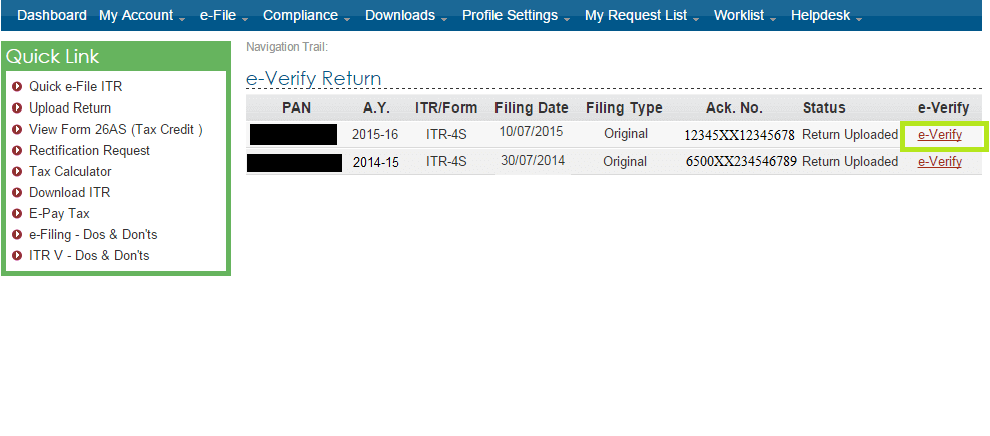

3. Click on the returns pending for e-verification option.

4. Select e-verify.

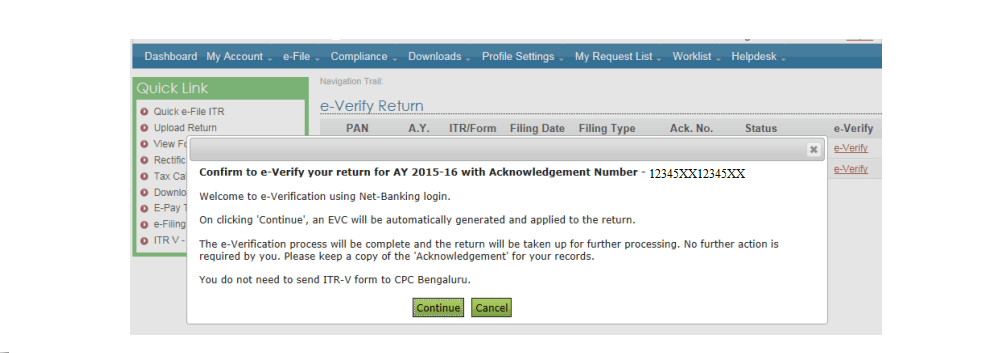

5. A small pop-up window will appear, asking for confirmation to e-verify, select continue. An EVC will be generated to verify your Income Tax Return.

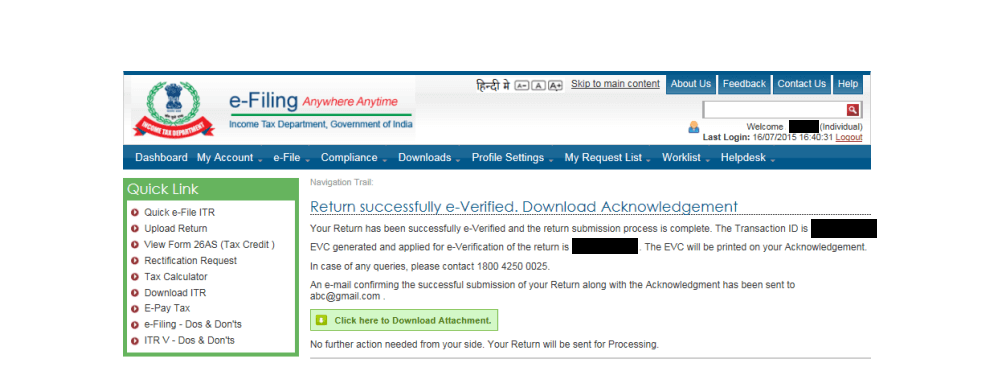

6. A verification confirmation message will display along with transaction ID and EVC code. Attachment can be downloaded as a record.

SCROLL TO TOP