Ways to increase credit limit with ICICI

SMS

SMS CRLIM <last 4 digits of card> to <5676766>

Credit limit will be increased to maximum available credit limit for eligible customers.

IMobile Pay App

Step 1- Go to ‘Cards, Loans & Forex’ section

Step 2- Select your ‘Card Number’

Step 3- Go to ‘Manage Card’

Step 4- Click on ‘Manage Credit Limit’ (under More options)

Step 5- Select the ‘Desired Credit Limit’

Step 6- Click on ‘Submit’.

You will receive confirmation message of credit limit increase in seconds and enhanced limit can be used instantly for making your next purchases.

Download Or SMS iMobile to 5676766 to get the download link

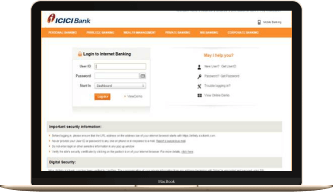

Internet Banking

Step 1- Log in to Internet Banking

Step 2- Click on ‘My Accounts’

Step 3- Select and click on ‘Credit Card’

Step 4- Go to ‘Manage Credit Limit’. Click on ‘Go’

Step 5- ‘Existing Credit Limit’ and ‘Maximum Credit Limit’ option will be available. Enter the ‘Desired Credit Limit’.

Step 6- You will receive an OTP on your registered mobile number, to authorise the transaction. Enter the OTP and click on ‘Submit’.

You will receive confirmation message of credit limit increase in seconds and enhanced limit can be used instantly for making your next purchases.

Customer Care

Kindly call ICICI Bank Customer Care on , and the Customer Care Executive will assist you with credit limit increase (if eligible).

Benefits of Increasing Credit Card Limit

Credit Cards have become a crucial part of our life. They can be used for everything right from small purchases to large expenses like vacations and home renovations. As your needs and income grows gradually, you can consider increasing yourCredit Card limit.

While there are potential risks associated with increasing your credit limit, there are also many benefits. In this article we will explore the benefits of increasing Credit Card limit.

What are the benefits of increasing a Credit Card limit?

Improved credit score: One of the most significant benefits of increasing your Credit Card limit is that it can improve your credit score. Your credit score is calculated based on several factors including your credit utilisation ratio. By increasing your credit limit, you can increase your available credit which can lower your credit utilisation ratio and improve your credit score.

Increased purchasing power: Another significant benefit of increasing your Credit Card limit is increased purchasing power. This can be especially beneficial in emergencies or for large purchases that may be difficult to pay for all at once.

Enhanced rewards: Many Credit Cards offer rewards programmes that provide cashback, points or other incentives for using the card. By increasing your credit limit you can take advantage of these rewards programmes more effectively.

Better financial flexibility: With a higher credit limit you have more options when it comes to making purchases and managing your finances. This can help you to feel more in control of your finances and manage unexpected expenses effectively.

Increasing your Credit Card limit can help you manage your finances better and achieve your financial goals. It is important to use credit responsibly and make sure that you are able to pay off your balance each month to avoid accumulating debt and paying high interest charges.

How the Credit Card Limit works for Multiple and Single Credit Cards

Multiple Credit Cards

Suppose, Mr. Rohan has 3 Credit Cards

Credit Limit of Card A is Rs 5 lakh

Credit Limit of Card B is Rs 3 lakh

Credit Limit of Card C is Rs 1 lakh

Maximum expenditure allowed to Mr. Rohan collectively from Card A + Card B + Card C is less than or equal to Rs 5 lakh.

Single Credit Card

Suppose, Mr. Rohan has 1 Credit Card with a credit limit of Rs 1 lakh

Maximum expenditure allowed to Mr. Rohan is Rs 1 lakh.

RECOMMENDED CREDIT CARDS

Popular Credit Card FAQs

Credit Card issuers may offer a credit card limit of one to three times the cardholder's monthly income. Therefore, someone with Rs 50,000 salary who has a good credit score might get a Credit Card limit of Rs 1,00,000 to Rs 1,50,000 per month.

Getting a Credit Card limit of 1 lakh or more depends on various factors such as your credit score, monthly income, employment status, credit history and existing debt obligations.

Yes, however it is not recommended to use 100% of your Credit Card limit. Most Credit Card companies charge high interest rates on the outstanding balance that you carry on your Credit Card.

The average Credit Card limit for an individual can vary depending on factors like the creditworthiness of the applicant, the Credit Card issuer and the individual’s income.

Mobile Banking

270+ banking and informational services to take care of your daily banking needs conveniently from your smartphone.

Internet Banking

User Internet Banking to avail of 300+ banking services from safety of your home

KNOW MORE

Branch & ATM

You can now do banking round the clock, even on Sundays and holidays!

FIND ICICI ATM

Recommended Other Products For you

Two-Wheeler Loans

Pre Owned Used Car Loan

Loan against Car

.png)