Inland Letter of Credit

Inland letter of credit is an obligation of the bank that opens the letter of credit (the issuing bank) to pay the agreed amount to the seller on behalf of the buyer, upon receipt of the documents specified in the letter of credit under domestic business transaction.

ICICI Bank issue Inland Letter of Credit on your behalf that gives you the advantage with your suppliers. Our experts advise you in drafting the Letter of Credit terms and conditions so as to protect your interests.

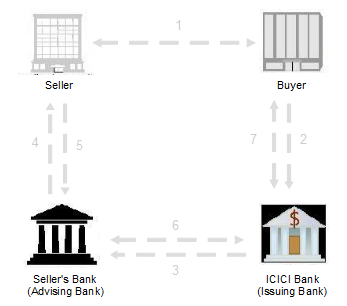

How does a Letter of Credit works?

- Step 1 - The buyer and seller enter into a contract stating that payment be made on the basis of Letter of Credit

- Step 2 - Buyer approaches ICICI Bank to issue Letter of Credit in favour of the seller

- Step 3 - ICICI Bank issues Letter of Credit which is advised through its branch or correspondent bank in the seller’s country

- Step 4 - Advising bank advises Letter of Credit to the seller

- Step 5 - Upon receipt of the Letter of Credit, the seller prepares shipment and delivers documents to seller's bank bank

- Step 6 - Presenting bank dispatches documents to ICICI for payment

- Step 7 - Buyer pays the document amount to ICICI Bank. In return, ICICI Bank forwards the documents to the buyer, who can now use them to obtain the goods.