THE

ORANGE

HUB

National Pension System Eligibility, Features, and Online Registration Guide

The National Pension System (NPS) is a transformative retirement savings scheme introduced by the Government of India, designed to provide financial security to individuals during their retirement. Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), NPS is designed to be an easily accessible, low-cost, tax-efficient, flexible, and portable voluntary contribution plan.

In this post, we shall discuss in detail the national pension system eligibility, its features, and the steps to open one online.

Eligibility Criteria for NPS

The National Pension System (NPS) has emerged as a popular choice, offering a structured approach towards getting help during the golden years. If you're considering enrolling in NPS, it's essential to understand the national pension system eligibility to start the process:

1. Age Requirement

The primary eligibility criterion for the NPS is age. Any Indian citizen, whether resident or non- resident, can join the NPS, provided they fall within the age bracket of 18 to 70. It allows young adults to start planning for their retirement early and seniors to manage their retirement and plan accordingly.

2. Citizenship

Both resident and non-resident Indians (NRIs) and overseas citizens of India (OCI) are eligible to invest in the NPS. This inclusivity ensures Indians working abroad have the benefits of securing finances for their retirement.

3. KYC Norms and Other Details

- KYC Compliance: You must follow Know Your Customer (KYC) norms to verify your

- Specific Ineligibilities: Hindu Undivided Families (HUFs) and Persons of Indian Origin (PIO) are not eligible to subscribe to NPS.

- Individual Accounts: NPS accounts are personal You cannot open an account on behalf of someone else.

- Legal Competence: You must be legally capable of entering into a contract, as defined by the Indian Contract Act.

Essential Features of the National Pension System

NPS, a government-sponsored retirement savings scheme, offers a structured approach to building a corpus for post-retirement years. Let us explore the key features, highlighting why it's increasingly becoming the preferred choice for retirement planning:

1. Accessibility and Portability

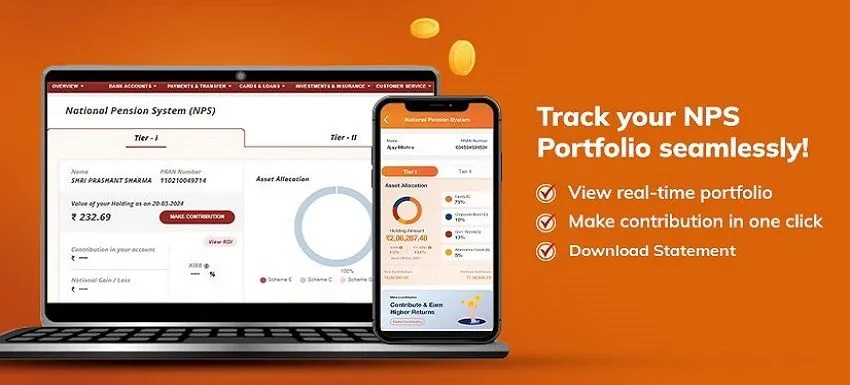

NPS is designed to be highly accessible and portable. Once registered, individuals can manage their accounts online using various mobile apps and internet banking. Due to this convenience, it is a viable option for voluntary subscription by any Indian citizen. The portability feature ensures an NPS account remains operational and accessible, even if the account holder changes their city or job.

2. Cost-Efficiency

One of the standout features of NPS is its low-cost structure. The cost-effectiveness of managing the NPS account is a major reason it has become an advisable and attractive option. With time, overturn can positively impact returns in the long run.

3. Flexibility in Contributions

NPS subscribers can customise their pension plans, including selecting a Point of Presence (PoP) for registration and support, choosing a Central Recordkeeping Agency (CRA) to manage account records, and picking a pension fund manager to handle investments. Moreover, these choices are flexible and can be changed later to suit evolving preferences and financial goals.

4. Tax Benefits

Investing in NPS comes with substantial tax benefits under the Income Tax Act 1961. Contributions made to the NPS are eligible for tax deductions, which can significantly reduce the taxable income of the investors, thereby offering dual benefits of savings and tax relief.

How to Open an NPS Account

Opening an NPS account is a straightforward process. Individuals can do this through mobile apps or internet banking provided by various leading institutions. ICICI Bank’s iMobile Pay is one such example. Here’s a quick guide:

Via Mobile Apps

1. Log in to the iMobile Pay Apps

Downloading and logging into the mobile apps is the initial step in the process. You can find the app on the App Store (iOS) or Google Play Store (Android). Once installed, log in using your Bank customer ID and password.

2. Navigate to 'Invest and Insure'

Within the app's main menu, locate and select the 'Invest and Insure' option. This section houses various investment and insurance-related services provided by the bank. From here, proceed to 'Instant NPS'.

3. Select Instant NPS

Look for the "Instant NPS" within the "Invest and Insure" section. This feature is designed for initiating investments into the National Pension System (NPS) directly through the app,

4. Fill in the Required Personal Details

Once you've accessed 'Instant NPS', you'll be prompted to provide several key details to complete your application enter personal and nominee details to designate who will receive the benefits of your NPS account in case of an unfortunate event.

5. Pre-Confirm and Submit

Review all the details you've entered for accuracy and completeness. Once you're satisfied with the information provided, confirm the details and proceed to submit your application.

Via Internet Banking

If you prefer using a desktop or laptop computer, you can open your NPS account through an internet banking platform. Here’s how:

1. Login to Bank’s Net Banking

Visit the official bank website and log in to your net banking account using your user ID and password.

2. Navigate and Go to 'Investments and Insurance'

Once logged in, navigate to the 'Investments and Insurance' section from the dashboard. This section provides access to various investment and insurance-related services offered by the bank.

3. Select 'National Pension System'

Within the 'Investments and Insurance' section, locate and click on 'National Pension System' to initiate the account opening process.

4. Fill Personal Details

Once you've accessed, you'll be prompted to provide several key details to complete your application. You must enter personal and nominee details to designate who will receive the benefits of your NPS account in case of an unfortunate event.

5. Pre-confirm and Submit

Before submitting your application, carefully review all the details you've filled in to ensure accuracy and completeness. Once verified, submit the application to generate Service Request which can be used to track your NPS account opening request. After verification your NPS account will be opened.

Conclusion

The National Pension System (NPS) is a flexible retirement planning tool that offers significant benefits to eligible individuals. Whether a young professional starting your career or someone nearing retirement age, NPS provides a reliable path to financial freedom in your golden years. By meeting the eligibility criteria and applying the scheme's key features, you can build a substantial retirement corpus, ensuring a secure and comfortable future.

Scroll to top