Government Schemes

What is National Pension System (NPS)?

NPS is an easily accessible, low cost, tax-efficient, flexible and portable, voluntary defined-contribution, retirement savings scheme introduced by the Government of India and regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

What are the key features of NPS?

1. Regulated - NPS is regulated by PFRDA, which is established through an Act of Parliament (PFRDA Act 2013)

2. Pension for all - can be voluntarily subscribed by any Indian citizen (resident/non-resident/overseas citizen)

3. Low cost – NPS is one of the low cost pension schemes in the world

4. Flexible - Subscribers have various options to choose from - Point of Presence (PoP), Central Recordkeeping Agency (CRA), Pension Fund and Asset Allocation, etc. The choices exercised can be changed subsequently

5. Portable – NPS Account can be transferred across employment, location(s)/geography(ies)

6. Tax efficient – Tax incentives are available to the subscribers under the Income Tax Act 1961.

7. Optimum returns – Market linked returns based on the investment choice made by the subscriber

8. Transparent – Subscribers can access their NPS Accounts online 24X7 and public disclosures are mandated.

What is the eligibility criteria for NPS?

- Any Indian citizen (resident or non-resident) and overseas citizen of India (OCI)

- Aged between 18-70 years

- Compliant to Know Your Customer (KYC) norms.

Hindu Undivided Families (HUFs) and Persons of Indian Origin (PIO) are not eligible for subscribing to NPS.

NPS is an Individual Pension Account and cannot be opened on behalf of a third person. The applicant should be legally competent to execute a contract as per the Indian Contract Act.

What is the All Citizen model?

Citizens of India who are financially not dependent like self-employed, professionals, etc. can open and contribute to his/her Individual Pension Account for creating a pension corpus from which regular income will be generated after retirement/working age.

What is a Corporate model?

This model is applicable for the employees working with corporates. Under this model, employee as well as the employer (on behalf of the employee), both can contribute towards the NPS Account of the employee.

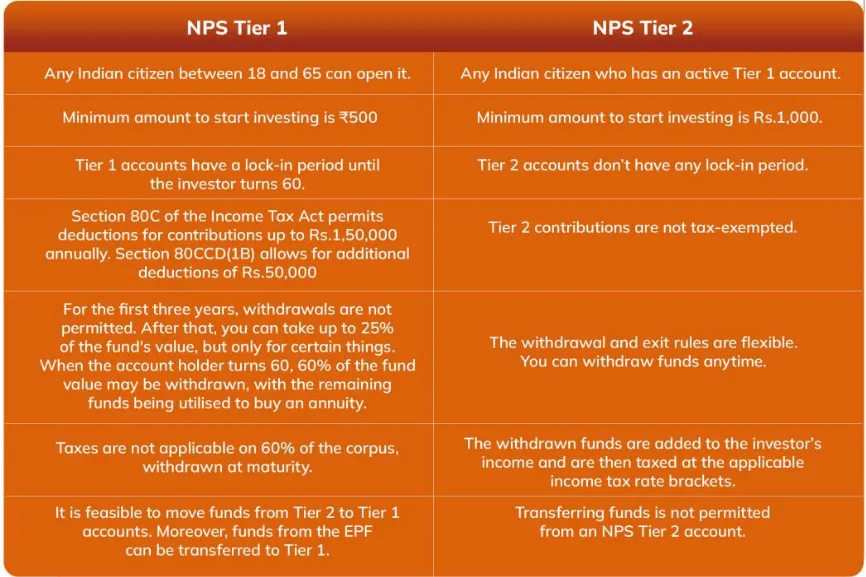

What is the difference between Tier I and Tier II Accounts?

Under the NPS Account, there are two types of Accounts - Tier I & Tier II. Tier I Account is mandatory and the subscriber has the choice to opt for Tier II Account.

How can I open an NPS Account online?

NPS Account can be opened with ICICI Bank in just 3 simple steps.

You need to log in to ICICI Bank Internet Banking or iMobile Pay App > Go to ‘Investment and Insurance’ > Select ‘National Pension System’ (NPS)

Step 1: Fill all the required details (investment, personal, nominee details)

Step 2: Upload your photo and signature

Step 3: Confirm all your details and then submit.

A Service Request Number and Permanent Retirement Account Number (PRAN) will be generated for processing (please save these numbers for future reference). The SR will be processed and your Account will be activated within 1 working day and it will be communicated to you through SMS on your registered mobile number.

*Initial minimum contribution amount along with the subscription application is ₹ 500/-

What are the tax benefits in NPS?

- NPS contributions are eligible for tax deductions under Sec. 80 CCD (1) of the Income Tax Act, up to 10% of basic + DA or up to 20% of gross income for self-employed within the overall ceiling of ₹ 1.50 lakh under Sec. 80 CCE.

- An additional deduction of up to ₹ 50,000/- is available under Sec. 80CCD 1(B) of the Income Tax Act.

- In case the subscriber receives contributions from the employer also, tax deduction under section 80 CCD (2) of the Income Tax Act may be claimed by the subscriber in addition to the tax benefits available under Sec. 80 CCE, subject to an aggregate limit of ₹ 7.5 lakh of contributions made towards NPS, Recognised Provident Fund and Approved Superannuation Fund.

What are the different Fund Management Schemes available to the subscriber?

NPS offers two approaches to invest the subscriber’s money:

a) Active choice – Here the individual would decide on the asset classes in which the contributed funds are to be invested and their percentages (Asset Class E (maximum of 75%), Asset Class C, Asset Class G and Asset Class A (maximum of 5%)

b) Auto choice - This is the default option under NPS wherein the management of investment of funds is done automatically based on the age profile of the subscriber.

How can I contribute online to the National Pension System (NPS) ?

Log in to www.icicibank.com

- Click on Payments & Transfer > Pay bills > Pension > National Pension System

- Register the biller by providing the required details i.e. PRAN, DOB, amount, payment type (one-time/recurring), etc. as available in ICICI Bank records.

- Preview the details filled and click on ‘Submit’ to register the biller and fund the NPS Account.

Once the biller is registered, you can directly contribute to your NPS Account through the registered biller anytime.

Please Note:

- First contribution towards National Pension System (NPS) needs to be made online within 45 days of PRAN generation or the Account will be frozen

- It will take 3 working days for the amount to reflect in the NPS Account, hence do not make another payment before 3 working days or the same will be reversed to your Savings Account.

What is the minimum amount required for NPS contribution?

Minimum contributions (for Tier-I)

- Minimum contribution at the time of Account opening and for the subsequent transactions – ₹ 500/-

- Minimum contribution per year – ₹ 1,000/- excluding any charges and taxes

- If the subscriber contributes less than ₹ 1,000/- in a year, his/her Account would be frozen and further transactions will be allowed only after the Account is reactivated

- In order to reactivate the Account, the subscriber will have to pay the minimum contribution amount.

Minimum contributions (for Tier-II)

- Minimum contribution at the time of Account opening – ₹ 100/- and for the subsequent transactions a minimum contribution of ₹ 250/- per year is required

- Under NPS, the manner in which your money is invested will depend upon the subscriber’s own choice. NPS offers a number of funds and multiple investment options to choose from. In case the subscriber does not want to exercise a choice, his/her money will be invested as per the ‘Auto Choice’ option, where the money will be invested in various types of schemes as per the subscriber’s age.

Where can I view my contribution towards NPS?

ICICI Bank provides NPS portfolio service where you can view the following details:

1. Total amount invested till date

2. Total holdings

3. Notional gain/loss

4. XIRR & FY-XIRR

5. PFM & scheme details

6. Asset allocation

7. Last five transactions

8. Download statements of the transactions for any financial year.

Can we have a Joint Account for the National Pension System ?

No, you cannot have a Joint Account for the National Pension System

When can I withdraw my money from the NPS Account?

A subscriber can withdraw their money from the NPS Account under the following circumstances/conditions:

1. Normal withdrawal – on completion of 60 years of age (if the subscriber has joined NPS before 60 years of age) or after completion of 03 years (if the subscriber has joined NPS after 60 years of age), the subscriber can withdraw maximum 60% of the corpus as lumpsum and minimum 40% of the corpus has to be utilised for purchasing an annuity plan for receiving the pension. If the accumulated corpus is less than ₹ 5 lakh, the entire corpus is paid as lumpsum to the subscriber.

2. Partial withdrawal - after completion of 3 years the subscriber can withdraw 25% of his/her own contributions for specific reasons like - illness, disability, education or marriage of children, purchasing property, starting a new venture, etc. A subscriber can partially withdraw up to a maximum of 3 times during his/her entire tenure.

3. Premature withdrawal - after completion of 5 years or before the completion of 03 years (if the subscriber joined NPS after attaining 60 years of age), subscriber can withdraw maximum 20% of the corpus as lumpsum and minimum 80% of the corpus has to be utilised for purchasing an annuity plan for receiving the pension. If the accumulated corpus is less than ₹ 2.5 lakh, the entire corpus is paid as lumpsum to the subscriber.

What if I don’t want to exit from NPS at 60 years of age?

If NPS All Citizen subscriber does not exit from NPS at 60 years of age, the Account will automatically continue to operate till the subscriber is 75 years old. Subscriber can exercise the option of normal exit from NPS at any point of time he/she wishes after 60 years of age. At the age of 75 years, the Account has to be closed mandatorily.

Invest in NPS today and contribute regularly to get attractive returns and tax benefits for a better tomorrow.