DIGITAL BANKING

Advance. Innovative. Instant

- Mobile Banking

- Net Banking

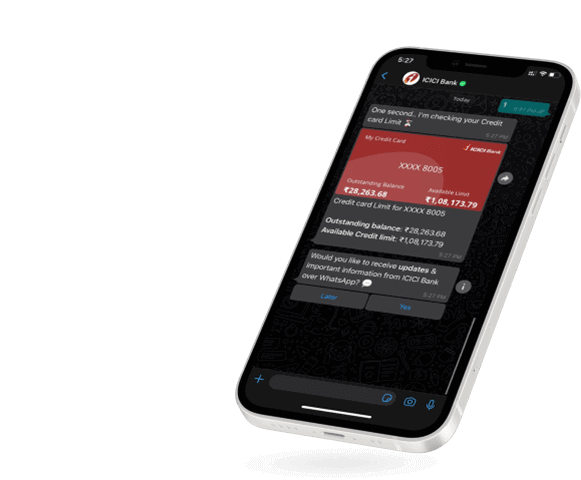

- WhatsApp Banking

DIGITAL BANKING

Advance. Innovative. Instant

Exciting deals on ICICI Bank Net Banking

Explore nowTrending Deals

Great Offers for Great Experiences